Banking innovation doesn’t stop at the hardware behind the desk. There are many areas of your financial institution that can benefit from a tech overhaul—like your lobby, your teller areas and your drive-up teller. If you’re still relying on manual-change rate boards and paper pamphlets, there’s value in considering modern upgrades like digital signage to create a powerful multi-channel customer experience.

Let’s face it, most of your customers, no matter their demographic, are engaged with a screen at some point in their day. They are used to absorbing information via technology—not the static, print mediums of the past. So, how can digital signage support your operations and give you the competitive edge you seek? Check out these four ideas, excerpted from our recent white paper, “Financial Institutions: 3 Technology Strategies to Help You Gain Competitive Advantage“.

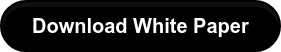

1. Lobby Signage

During peak hours, your tellers, account managers, loan officers and other team members can become quite busy, leaving customers with a wait time, either standing in line, or sitting in your waiting area. Digital signage is an excellent tool for entertaining and informing them. It has multiple setup options for doing both.

For example, play local news programming while running a sidebar of your interest rates on various investment products. Share entertainment programming, such as movies or television shows, while running a scroll on the bottom of the screen that shares financial news from the stock market; interest rates; or other important information. Your customers will appreciate not having to repeatedly thumb through your brochures, and you’ll be subtly (or not so subtly!) advertising all that you have to offer as they wait.

2. Teller Signage

Depending on your layout, you may have ample real estate for signage behind your tellers. Why not share your latest offers on screens instead of banners or posters?

You can also change your content on the fly without distracting customers and impeding your tellers. With a few clicks, you can rapidly switch out the information playing on your screen to match high-profile times of day, types of customers or even a recent news announcement (e.g. during a local news story about dropping mortgage interest rates; you can share your financial institution’s latest mortgage promotion). Additionally, display wait times and redirect customers to self-service areas to reduce frustration.

3. Outdoor Digital Signage

Like the lobby, your drive-thru can get busy during peak hours. Use signage to inform your customers about their wait times, re-direct them to the lobby (no wait inside!) and share the best hours to avoid wait times. You can also advertise your financial services or share upcoming seminars and opportunities.

Along busy streets, you can share more than the time and temperature. Let potential customers know what you have to offer—and why they should consider your bank over the competition.

4. Banking Kiosks

Kiosks are digital signage, too. Give your customers the choice of automating their simpler transactions and save them time while also freeing up your tellers to handle complex banking tasks. Interactive touchscreen kiosks can process money transfers, applications, pre-approvals and more. You can also include the money-handling features of traditional ATMs, information/FAQs and scheduling features. Show your customers that you can have them in and out of the branch in minutes, even during peak hours, and you’ll gain the edge on financial institutions that still require traditional counter engagement for most transactions.

Digital signage is the modern way to engage your customers, share and adapt your messaging on the fly and advertise your latest offerings. Set yourself apart as a financial institution that embraces technology and constantly innovates to achieve the best customer service possible.

Check out our full white paper to learn more!

!–HubSpot Call-to-Action Code –>